How to Use Your Money As A Tool,

Become Financially Fit &

Build Your Wealth

This course is available and delivery within a few hours!

Jaspreet Singh – The Climb To Wealth Blueprint

First, I need to share a story about a friend of mine named Alex.

Alex is a software engineer who lives in the San Francisco Bay Area.

He is 29 years old, single, and $250,000 in debt.

His debt consists of state, private, and federal student loans he took out to attend Northwestern University in Chicago.

Great school, superb education, and lots of fun…

But looking back, Alex says that it was the single worst decision of his young life.

Here’s why:

- The monthly payment on his debt is $2,738

- His monthly income from work, after taxes and his healthcare contribution, is about $3,904

- He’s left with about $1,166 to pay all of his essential monthly living expenses like rent, utilities, food, car, gas, etc…

Every month, Alex barely makes it. His checking account reads zero at the end of every month. (If he’s lucky)

And, he has no life because he can’t afford to go out or travel.

Every time he gets a bonus from his job, his money disappears.

Alex is in financial prison.

He is serving a 10-year prison sentence for a bad decision that will end up costing him $78,560 in total interest on his loan, taking the cost of his education to $328,560.

Alex is just one of millions of adults who are being punished under crushing debt levels that they were told was okay to take on.

Well, “THEY” got it wrong!

It’s an expensive lesson no doubt, but it’s one Alex will never make again.

The truth is, being financially free goes way beyond the size of your paycheck.

Sure, the size of your paycheck can help. But if you don’t know how to use your money – you will always be broke.

And unfortunately, most of us are never taught how to use money to build wealth.

Here’s how you can learn from Alex’s mistake, and start living life on your terms…

The truth is, building wealth is kind of like climbing a mountain. The goal is to get to the top – but how the heck do you get there?

By coming up with a plan and climbing one step at a time.

Here are the 5 steps to C.L.I.M.B. To Wealth:

Step 1: Create Your Financial Base

Have you ever been to, or seen pictures of, the Great Pyramids in Egypt?

How you build your base is everything.

It starts by stopping the financial bleeding that is caused by high-interest debts.

This would include anything that is costing you over 12% a year like:

- Credit cards

- Cash advance loans (also known as ‘Fast Cash’ loans)

- Merchant cards for things like furniture, clothing, electronics, etc.

It might seem like an impossible task, especially when you are always playing catch-up.

But there is a solution…

I’m going to show you how you can build a $2,000 savings fund within the next 90 days.

This way you never have to worry about going into debt for a small emergency again.

Then I’m going to give you 3 strategies to help you eliminate your high interest debts very quickly.

Step 2: Lead Your Money

What’s passive income?

It’s income that you are not actively involved in earning.

You need to create passive income if you ever want to be wealthy.

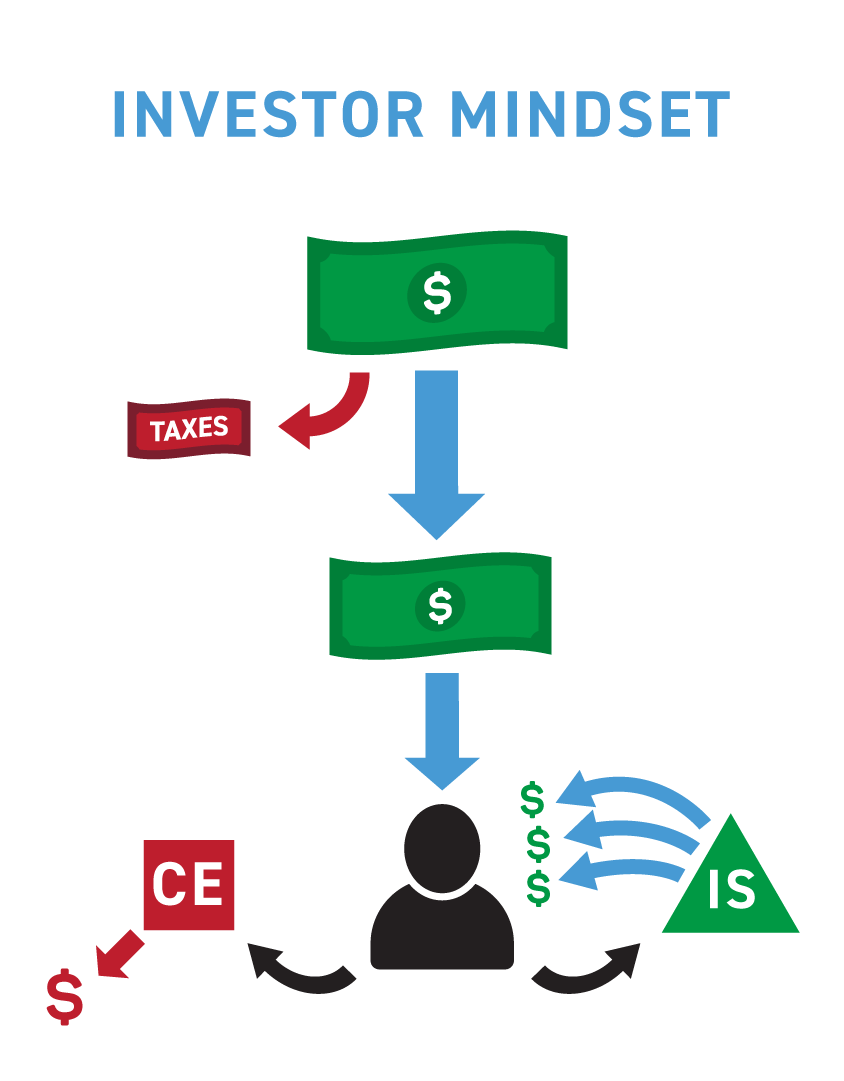

The majority of people have a consumer mindset.

They make money, pay the highest taxes, and then use whatever money is left to buy (or finance) things that rapidly decline in value.

I call these things consumer expenses (labeled ‘CE’ below).

I’m going to show you how you can use your money as tool to attract you more money.

We are living in a debt culture.

It’s completely normal to make $1 and then go out and spend $1.25.

You don’t have to be a math genius to understand that this is not going to end well.

That is…unless you’re a bank.

Banks LOVE it when you are SO FINANCIALLY STUPID!

They make BILLIONS of dollars every year because you don’t understand how the game works.

Well, enough of that…

In this step, I’m going to show you how to use your money to build your own wealth. Not wealth for the banks and credit card companies.

So you’re going to learn how to get rid of your remaining debts (student loans, car payments, mortgage).

Plus, I’m going to give you a lot of tips on how to spend your money in the future.

Step 4: Multiply Your Income

Financially speaking, working harder at your job is the worst way to grow your income.

Here’s why:

- You get paid for your time. When you don’t work, you don’t get paid.

- You limit the amount of money you can make because there’s a limit to how many hours you can exchange for dollars

- Working hard for someone else is expensive. You pay the highest taxes.

I have the option to be a high-paid employee (I’m a licensed attorney).

As a business attorney, I could charge $250 per hour for legal services.

But financially, it doesn’t make sense for me for 3 reasons…

1. I don’t like selling my time for money;

2. I’d have to pay the highest taxes; and

3. It’s not my passion.

I’m going to show you how to work smart to create a side income from the internet, even if you’re working a job or going to school.

I think it’s the smartest way to work hard in this new economy.

This way, you can do the work once and get paid for it years into the future.

I’ll also show you how to pay less in taxes using strategies approved by the IRS.

Step 5: Be Great

Your family is depending on you to be smart with your money.

When you keep more, you have more, and you can do more.

Does that make sense?

I’ll teach you how to protect your new wealth from the people who want to take it from you, and hurt your way of life.

Don’t let it happen.

I’m also going to show you how you can incorporate giving into your lifestyle because the more you have, the more you can do.

Traditional Financial Planning

Won’t Make You Wealthy…

We are in a new financial era.

In the 1970s there were…

- No cell phones.

- No personal computers.

- No webbanking.

- No Facebook.

And very limited financial education.

Times have changed. Our economy has changed. But the way we are taught to use our money hasn’t changed one bit.

Stop being a dinosaur and get with the times.

Just because the masses do something doesn’t mean it’s right…sometimes the ‘m’ is silent.

Here’s what traditional financial planning looks like:

1. Get a degree

The cost of getting a degree has been skyrocketing (college tuition has increased by 1,120% since 1978 – that’s much faster than inflation), while your salary hasn’t been keeping up.

That means you have to pay significantly more to make the same amount of money, while the cost of living keeps increasing.

Great…

Welcome to the “real world” with a whole lot of debt.

2. Work hard at your job

In the old economy, if you followed the traditional system where you went to school (with little to no debt), got a job and worked there for forty-five years you were pretty much guaranteed to live a good life.

You had job security, a work-life balance, and enough vacation time.

You could afford to enjoy life and you were spoon-fed a retirement with social security or a pension.

Now, in the new economy things are very different.

Job security is a thing of the past with outsourcing, automation, & robots. You have to bust your butt to get a week of vacation, the 401(k) sucks and Social Security is hanging on by a thread.

This doesn’t mean all hope is lost. This means you have to stop being a dinosaur and understand how money works in this new economy.

3. Invest in your 401(k)

Believe it or not, the 401(k) is not risk free, it’s very expensive, you don’t get great tax breaks, and the returns aren’t that good.

There are simple alternatives that allow you to keep more money in your pocket.

I’ll be talking more about this in the myths section below.

4. Save your money

Have you ever heard people talk about how cheap things used to be in the past?

In 1970 a gallon of gas cost $0.36. Now, it’s many times more than that.

Ever wonder why?

It’s because inflation drives the price of things up every year.

When you save your money, your money isn’t growing, even though your rent, your groceries, your car, and your healthcare is getting more expensive.

Strategic saving does have its place so you don’t have to go into debt when an emergency happens. But saving won’t make you rich…or wealthy.

So what can you do to build your wealth?

Well, you can start by budgeting your money and live below your means. Lots of people start that way. But they’re quick to discover that the “live below your means” strategy by itself doesn’t work to build wealth unless you have something more.

Without proper financial education, you can’t master money.

You use money every single day. You need to understand how it works.

Mastering money in this new economy to build your wealth…

The majority of people are playing in this new economy with old economy rules.

It’s more important than ever to learn how to use your money as a tool and create multiple streams of income.

I tried a bunch of things…

- Penny stock trading. A proven way to make tons of money?! Nope. A very expensive lesson.

- Online surveys. The only thing this gave me was a virus on my computer.

- Fixed rate CDs. Crappy returns & you can’t use your money for years. Not a good combo.

- High margin stock trades. Debt amplifies your mistakes when you’re inexperienced.

- Living wayyy below my means. Yes, this works – but you have to do it strategically.

- Buying “get rich quick” programs. I’ve purchased some and I’ve been scammed by others. You can’t sacrifice the sacrifice.

These were expensive lessons, but they taught me what I know now. It’s important to learn from your mistakes.

But it’s a whole lot cheaper to learn from someone else’s mistakes.

The good news is, I spent countless hours compiling my financial journey into a course that will show you how to use your money as a tool to build your own wealth.

Week 1: Create Your Financial Base

Lesson 1 – Strategic Saving: Create a plan on how to save your money so you can create a savings fund and learn how to pay off your high interest debts immediately.

Lesson 2 – Saving Will Not Make You Rich: The majority of people become poorer when they save their money. That’s why you have to learn how to save strategically

Lesson 3 – Proven Strategies to Create Your Financial Base: Learn three strategies you can apply right away to save money and pay off your high interest debts.

Lesson 4 – My Story: Hear an in-depth story about my financial journey.

Lesson 5 – Unexpected Ways to Save More Money: Learn 8 strategies you can use to keep more money in your pocket.

Week 2: Lead Your Money

Lesson 1 – Let Your Money Make You Money: You will create a money management system while learning about the difference between active and passive investments.

Lesson 2 – Why Retirement Is A Lie, Your 401k & Investing Explained: Retirement is an old model. Learn about retirement & 401(k) alternatives.

Lesson 3 – What Goes Up Must Come Down: We will dive deep into market & economic cycles, what causes them, and how you can find discounted investment opportunities in any economy.

Lesson 4 – What Is Money: What is your $100 bill worth? See how money is valued, how money is created, and how to protect your assets against inflation.

Lesson 5 – How You Can Start Investing Today: A action-driven lesson, you will be given multiple strategies to start investing today.

Lesson 6 – Why Wealthy People Invest in Real Estate: See how real estate investing works to create passive income, how you can get started, learn about real estate tax breaks, and things you should look for as a real estate investor.

Lesson 7 – Shopping with The Minority Mindset – Stock Market Investing: Ever wonder how you can make money when other people spend money? This is how.

Lesson 8 – Lending Money – Banks Never Lose: Banks have created a profitable game where they make money by issuing loans. How can you model them?

Lesson 9 – Should You Invest with Debt: Learn about how you can strategically use debt as an investor, and see the easiest million dollar deal I ever did.

Lesson 10 – Saving Vs. Investing Which Is Riskier: What’s safer, saving your money or investing? We will do an in-depth analysis to see how risky investing really is.

Week 3: Interest Free Living

Lesson 1 – Stop Making Your Banker Richer: See how much money you are wasting by financing things & learn how to pay off your remaining debts very quickly.

Lesson 2 – What Can You Afford: Learn how wealthy people spend their money and see how you should spend your money with budgeting tips.

Lesson 3 – Get Paid to Spend: Credit cards can be very lucrative if you use them correctly – you will learn how.

Lesson 4 – Should You Buy A House Vs Rent: Unlike what many people believe, owning a home isn’t always the right answer. See what’s best for you.

Lesson 5 – How To Buy Your Next Car: Cars depreciate in value quickly. Learn how to buy a car so you can keep the most money in your pocket.

Week 4: Multiply Your Income

Lesson 1 – Earn More Money the Right Way: Financially speaking, working harder at your job is the worst way to make money. There is an alternative.

Lesson 2 – Create an Income Generating Machine: Not all businesses are made the same. Study how some businesses can create reoccurring income.

Lesson 3 – Discover the Power of The Internet: The internet changed the way business is done. No, you won’t have to do any lame surveys.

Lesson 4 – Fail Your Way to Success: Making mistakes and failing is a part of being successful. I’m going to share a number of my failures and what I learned from them.

Week 5: Be Great

Lesson 1 – You Only Live Once: Climb to the top of the mountain so you can see the world, not so the world can see you. This is about wealth protection & giving back.

Lesson 2 – Protect Your Assets: Estate planning, how to use legal tax shields, and asset protection strategies. These are advanced strategies to protect your wealth.

Lesson 3 – Light Someone’s Candle: The more you have, the more you can do. Learn to incorporate giving into your lifestyle at every stage of your financial journey.

Course Features

- Lecture 0

- Quiz 0

- Duration 10 weeks

- Skill level All levels

- Language English

- Students 121

- Assessments Yes